In order to address her son Aaron’s behavior, a loving mother named Heidi Johnson wrote him a compassionate letter. She posted this letter to Facebook at first, believing that only her friends would read it. But it went viral and attracted a far larger audience—a result she did not foresee but does not regret.

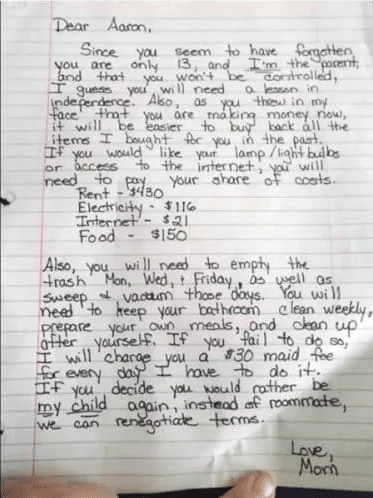

In response to her 13-year-old son treating her more like a “roommate” than a parent, Heidi wrote this letter. She showed him a comprehensive account that included rent, food, and other expenses totaling more than $700 in order to emphasize the obligations of independence. It was meant to give him a taste of what it would really take to live alone.

Her actions were motivated by love and care, as seen by the letter’s loving signature, “Love, Mom.” She clarified her intentions for anyone who could have misinterpreted them in a later update. She was always more concerned with teaching her kid to be thankful for what he had and to grasp adult duties than she was with having him actually pay the bill. She said, “If my 13-year-old is unable to pay his rent, I don’t plan on evicting him.” “I just want him to appreciate the blessings and gifts in our lives, love his home, and respect his personal space.”

After Aaron lied about finishing his homework, the decision was made to compose the note. He cheekily said, “Well, I am making money now,” when Heidi mentioned that she would have to restrict his internet access. Aaron was talking about the meager money he was making from his YouTube channel, which was obviously not enough to cover his basic expenses like food and housing.

Heidi’s relationship with her son is still as strong as ever, even in spite of the widespread attention her post received. “I still have open discussions with him. “He’s apologized several times,” she said.

Heidi has been a confidante to many parents who have reached out to her for guidance since the letter was posted online. “My post seems to have opened doors,” she said. “People feel at ease approaching me—they share their frustrations, seek advice, or just want someone to listen and share bits of my personal experiences.”